moitruong24h.ru

Market

Anwpx Stock Price

New Perspective Fund (Class A | Fund 7 | ANWPX) seeks to provide long-term growth of capital For Class A Shares, this chart tracks the high and low prices at. ANWPX Fund, USD %. At this time The successful prediction of New Perspective stock price could yield a significant profit to investors. American Funds Inc ANWPX:NASDAQ · 52 Week High · 52 Week High Date08/30/24 · 52 Week Low · 52 Week Low Date10/27/23 · Dividend Yield · Net Assets. A high-level overview of American Funds New Perspective Fund® A (ANWPX) stock. Stay up to date on the latest stock price, chart, news, analysis. Analyze the Fund American Funds New Perspective Fund ® Class A having Symbol ANWPX for type mutual-funds and perform research on other mutual funds. Historical stock closing prices for American Funds New Perspective Fund® A (ANWPX). See each day's opening price, high, low, close, volume, and change %. Discover historical prices for ANWPX stock on Yahoo Finance. View daily, weekly or monthly format back to when American Funds New Perspective A stock was. Category World Large-Stock Growth. Performance Rating Above Average. Risk Rating Average. Stock Exchange NASDAQ. Ticker Symbol ANWPX. Index MSCI AC World NR USD. T. Rowe Price Blue Chip Growth Fund, Inc. $ + +%. New Perspective Fund (Class A | Fund 7 | ANWPX) seeks to provide long-term growth of capital For Class A Shares, this chart tracks the high and low prices at. ANWPX Fund, USD %. At this time The successful prediction of New Perspective stock price could yield a significant profit to investors. American Funds Inc ANWPX:NASDAQ · 52 Week High · 52 Week High Date08/30/24 · 52 Week Low · 52 Week Low Date10/27/23 · Dividend Yield · Net Assets. A high-level overview of American Funds New Perspective Fund® A (ANWPX) stock. Stay up to date on the latest stock price, chart, news, analysis. Analyze the Fund American Funds New Perspective Fund ® Class A having Symbol ANWPX for type mutual-funds and perform research on other mutual funds. Historical stock closing prices for American Funds New Perspective Fund® A (ANWPX). See each day's opening price, high, low, close, volume, and change %. Discover historical prices for ANWPX stock on Yahoo Finance. View daily, weekly or monthly format back to when American Funds New Perspective A stock was. Category World Large-Stock Growth. Performance Rating Above Average. Risk Rating Average. Stock Exchange NASDAQ. Ticker Symbol ANWPX. Index MSCI AC World NR USD. T. Rowe Price Blue Chip Growth Fund, Inc. $ + +%.

New Perspective Fund, Class A S (ANWPX) - Price History ; June , $, $ ; May , $, $ ; April , $, $ ; March , $ Real time New Perspective Fund (ANWPX) stock price quote, stock graph, news & analysis. In pursuing its investment objective, it invests primarily in common stocks that the investment adviser believes have the potential for growth. Market Cap. The. Search for Stocks, ETFs or Mutual Funds. Search. Please enter a valid Stock, ETF, Mutual Fund, or index symbol. American Funds New Perspective Fund® Class A. View the latest American Funds New Perspective Fund;A (ANWPX) stock price, news, historical charts, analyst ratings and financial information from WSJ. T. Rowe Price Instl Global Equity, TRGSX, % ; Vanguard Global Equity Inv, VHGEX, % ; Vanguard Total World Stock Index Fund Institutional Shares, VTWIX. Investment style (stocks), Market Cap: Large Investment Style: Growth ; Launch date, ; Price currency, USD ; Domicile, United States ; Symbol, ANWPX. , Expense Ratio: Annual Report | Fee Level Comparison Group: World Stock Front Load. Other Fees. Management Actual. %. Management Maximum. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded. Latest American Funds New Perspective Fund® Class A (ANWPX) share price with interactive charts, historical prices, comparative analysis, forecasts. The average price target is $ with a high forecast of $ and a low forecast of $ The average price target represents a % change from the. Low commission rates start at $0 for U.S. listed stocks & ETFs*. Margin loan rates from % to %. Open An Account. View Disclosure. 2. Gemini · logo. The New Perspective Fund, Class A Shares (ANWPX) is a mutual fund that aims to provide investors with a diversified portfolio of global equities. All quotes are in local exchange time. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at. Get American Funds New Perspective Fund® Class A (ANWPX.O) real-time stock quotes, news, price and financial information from Reuters to inform your trading. ANWPX - New Perspective Fund - American Funds New Perspective Fund Class A Stock - Stock Price, Institutional Ownership, Shareholders (MUTF). This fund has multiple managers, view ANWPX quote page for complete information. Rowe Price Global Stock Fund (12/95). PRGSX. Dividend history for stock ANWPX (New Perspective Fund, Class A S) including historic stock price and split, spin-off and special dividends. New Perspective. stock price has recovered. High Yield. Yields over 4% ››. Stocks, ETFs, Funds ANWPX % Rank. Stocks, %, %, %, %. Cash, %, Get the latest New Perspective Fund Shares (ANWPX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals.

Nymex Wti Crude

It is a price in USD per barrel equal to the penultimate settlement price for WTI crude futures as made public by NYMEX for the month of production per Crude Oil WTI (NYM $/bbl) Front Month CL.1 (U.S.: Nymex). search. View All companies. PM EDT 09/06/ $ USD; %. Volume , Open. NYMEX Crude Oil Front Month ; Price (USD) ; Today's Change / % ; Shares tradedk ; 1 Year change% ; 52 week range - NYMEX Light Sweet Crude Oil (CL) futures are settled by CME Group staff based on trading activity on CME Globex during the settlement period. First launched by the New York Mercantile Exchange (NYMEX) in , WTI futures are the go-to derivatives product for the trade of light-sweet crude oil. In. The most widely traded WTI Crude Oil contracts (CL) are traded on the NYMEX, one of four exchanges owned by the CME Group. Brent Crude's primary exchange is. Commodity Futures Price Quotes For WTI Crude Oil (NYMEX) (Price quotes for NYMEX WTI Crude Oil delayed at least 10 minutes as per exchange requirements). Interim Staff Report on Trading in NYMEX WTI Crude Oil Futures Contract Leading up to, on, and around April 20, Links. PDF. Staff Reports. Resources. View live Light Crude Oil Futures chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well. It is a price in USD per barrel equal to the penultimate settlement price for WTI crude futures as made public by NYMEX for the month of production per Crude Oil WTI (NYM $/bbl) Front Month CL.1 (U.S.: Nymex). search. View All companies. PM EDT 09/06/ $ USD; %. Volume , Open. NYMEX Crude Oil Front Month ; Price (USD) ; Today's Change / % ; Shares tradedk ; 1 Year change% ; 52 week range - NYMEX Light Sweet Crude Oil (CL) futures are settled by CME Group staff based on trading activity on CME Globex during the settlement period. First launched by the New York Mercantile Exchange (NYMEX) in , WTI futures are the go-to derivatives product for the trade of light-sweet crude oil. In. The most widely traded WTI Crude Oil contracts (CL) are traded on the NYMEX, one of four exchanges owned by the CME Group. Brent Crude's primary exchange is. Commodity Futures Price Quotes For WTI Crude Oil (NYMEX) (Price quotes for NYMEX WTI Crude Oil delayed at least 10 minutes as per exchange requirements). Interim Staff Report on Trading in NYMEX WTI Crude Oil Futures Contract Leading up to, on, and around April 20, Links. PDF. Staff Reports. Resources. View live Light Crude Oil Futures chart to track latest price changes. Trade ideas, forecasts and market news are at your disposal as well.

View the latest Crude Oil WTI (NYM $/bbl) Front Month Stock (CL.1) stock Crude Oil WTI (NYM $/bbl) Front Month CL.1 (U.S.: Nymex). search. View All. WTI Crude Oil e daily price charts for the futures contract. See TradingCharts for many more commodity/futures quotes, charts and news. As a result, there has been a rapid buildup in crude oil and refined product inventories, which has driven market fears of running out of storage space. Oil. Stock analysis for CL1. Get stock price, historical stock charts & news for Generic 1st 'CL' Future. WTI Crude (Oct'24) @CLNew York Mercantile Exchange ; Open ; Day High ; Day Low ; Prev Close ; 10 Day Average Volume, Find the latest NYMEX WTI Crude Oil 1 month cal (CAYZNYM) stock quote, history, news and other vital information to help you with your stock trading and. Barchart Symbol, CL. Exchange Symbol, CL. Contract, Crude Oil West Texas Intermediate. Exchange, NYMEX. Tick Size, 1 cent per barrel ($ per contract). NYMEX Futures Prices (Futures prices after April 5, , are not available). (Crude Oil in Dollars per Barrel, All Others in Dollars per Gallon). Period. The Nymex roll is a calculation to determine the physical price of crude at WTI Cushing using a futures contract price. Get Crude Oil Front Month Futures (CLc1) real-time stock quotes, news NYMEX Crude Oil. CLc1. Official Data Partner. Latest Trade. trading lower NYMEX - Light Sweet Crude $/bbl (Month Rolling Avg.) NYMEX - Light Sweet Crude $/bbl (3-Month Rolling Avg.) WTI Cushing $/bbl, WTI Cushing $/bbl (Month. Explore real-time Crude Oil futures price data and key metrics crucial for understanding and navigating the Crude Oil Futures market. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract traded on the New York Mercantile Exchange (NYMEX). The WTI oil grade is also. ("NYMEX") and Commodity Exchange, Inc. ("COMEX") are not related to The NASDAQ Stock Market ("NASDAQ"). The marks NYMEX and COMEX are market data concerning. Interactive chart showing the daily closing price for West Texas Intermediate (NYMEX) Crude Oil over the last 10 years. The prices shown are in U.S. Today's Crude Oil WTI prices with latest Crude Oil WTI charts, news and Crude Oil WTI futures quotes October Nymex natural gas (NGV24) on Friday closed up by. NYMEX WTI Crude Oil Futures contracts are traded based on price movements on the physical crude oil prices. To know more on NYMEX. WTI Crude Oil Futures. Updated Price for Crude Oil WTI (NYMEX: CLV24). Charting, Price Performance, News & Related Contracts. Oil Index-Based Major Portion (IBMP), Indian Gas Major Portion, Federal Gas Index Option, NYMEX Oil Prices, and Crude Oil Market Centers. The Unbundling. WTI Nymex Prices Date, Name CM = 1st to 31st of month. OM = 26th to 25th of month, Price. Compliments of GASearch Energy Intelligence ()

How Much Bodily Injury Should I Carry

Recommended Coverage Limits: We suggest that you buy Bodily Injury Liability coverage in the amount of $, per person/$, per incident (accident), at. Bodily Injury Liability – $25, per person and $50, per incident; Property Damage Liability – $25, per incident. Physical Damage Insurance. Physical. To protect your finances and others on the road, Texas auto insurers say you should carry at least $, per person and $, per accident in bodily. $50, in bodily injury liability per accident (two or more people injured) A more serious spinal cord injury could cost well over $, Consider. At minimum, you should carry a // policy. This provides bodily-injury coverage of at least $, per person, and $, per accident, and property. $50, for bodily injury or death to all persons in any one accident; and; $15, for property damage in any one accident. Self‑insurance. Any individual who. Recommended Coverage Limits: We suggest that you buy Bodily Injury Liability coverage in the amount of $, per person/$, per incident (accident), at. If you cause an accident in California and you're carrying just the minimum of $10, in property damage coverage, virtually every new car (and even most used. Up to $, for each accident if several people are hurt or killed. Up to $10, for property damage in another state. Drivers may have the option of. Recommended Coverage Limits: We suggest that you buy Bodily Injury Liability coverage in the amount of $, per person/$, per incident (accident), at. Bodily Injury Liability – $25, per person and $50, per incident; Property Damage Liability – $25, per incident. Physical Damage Insurance. Physical. To protect your finances and others on the road, Texas auto insurers say you should carry at least $, per person and $, per accident in bodily. $50, in bodily injury liability per accident (two or more people injured) A more serious spinal cord injury could cost well over $, Consider. At minimum, you should carry a // policy. This provides bodily-injury coverage of at least $, per person, and $, per accident, and property. $50, for bodily injury or death to all persons in any one accident; and; $15, for property damage in any one accident. Self‑insurance. Any individual who. Recommended Coverage Limits: We suggest that you buy Bodily Injury Liability coverage in the amount of $, per person/$, per incident (accident), at. If you cause an accident in California and you're carrying just the minimum of $10, in property damage coverage, virtually every new car (and even most used. Up to $, for each accident if several people are hurt or killed. Up to $10, for property damage in another state. Drivers may have the option of.

The third and final number represents the maximum amount of property damage liability coverage. In this example, there is $, available to pay for. How to find your BI liability limits · $25, of bodily injury coverage per person · $50, of bodily injury coverage per accident · $25, of property damage. Recommended coverage is generally higher, and can range from $15,/$30, to $,/$, or more. As explained below, you must have bodily injury. See ORS The minimum insurance a driver must have is: Bodily injury and property damage liability. $25, per person;; $50, per crash for bodily. The per-person limit applies to each person injured in an accident. For example, say your per-person limit is $50, That means if one person is injured in a. This means liability coverage of $25, for all claims for bodily injury damages sustained by any one person and not less than $50, for all bodily. Property Damage Liability: Covers repairs to the victim's property (cars, fences, land, etc.). When you're shopping for insurance, this number is third after. $50, for bodily injury (not resulting in death) sustained by two or more persons in any one accident, or $, for any injuries resulting in death. How to find your BI liability limits · $25, of bodily injury coverage per person · $50, of bodily injury coverage per accident · $25, of property damage. South Carolina requires you to carry a minimum of $25, per person for bodily injury and $50, for all persons injured in one accident. Claims for bodily. As a general rule, you should have enough bodily injury liability insurance to cover your net worth. Your insurance company will never cover expenses that go. At minimum, you should carry a // policy. This provides bodily-injury coverage of at least $, per person, and $, per accident, and property. Bodily Injury Liability (BI) What: This coverage protects YOUR assets if you cause a crash and another person files a lawsuit against you. If you have sizable. By law, most states require that you have certain types of coverage with minimum liability limits. Many insurers recommend that your bodily injury liability. $25, for bodily injury (not death) to one person in any one accident · $50, for injury resulting in the death of one person in one accident · $50, for. Even if you have zero to little assets, it's still advisable to carry as much bodily injury liability as possible, because the more bodily injury coverage you. Vehicles registered as taxis must carry bodily injury liability (BIL) coverage of $, per person, $, per occurrence and $50, for (PDL) coverage. Liability insurance covers bodily injury and property damage to others as a result of a crash for which you are responsible. The minimum required limits are. Answer: Drivers are required to carry liability and uninsured motorist coverage with the following limits: $25, Bodily Injury Per Person / $50, Bodily. Considering the cost of new cars and their repair, I would recommend no less than $, property damage limit. For liability, I recommend

Debt To Income Ratio For A House

"A strong debt-to-income ratio would be less than 28% of your monthly income on housing and no more than an additional 8% on other debts," Henderson says. Why Your DTI Is So Important · Front end ratio is a DTI calculation that includes all housing costs (mortgage or rent, private mortgage insurance, HOA fees, etc.). How is the debt-to-income ratio calculated? To calculate your DTI, add up all of your monthly debt payments, then divide by your monthly income. Your debt-to-income ratio consists of two separate percentages: a front ratio (housing debt only) and a back ratio (all debts combined). A ratio? That sounds complicated, but it's just a numerical way to draw a comparison. Here, we're comparing overall housing and debt payments to pre-tax income. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. Debt-to-income ratio for mortgage FAQs Most lenders would prefer their applicants to have a debt-to-income ratio of 43% or less, ideally at 36% or less. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or. "A strong debt-to-income ratio would be less than 28% of your monthly income on housing and no more than an additional 8% on other debts," Henderson says. Why Your DTI Is So Important · Front end ratio is a DTI calculation that includes all housing costs (mortgage or rent, private mortgage insurance, HOA fees, etc.). How is the debt-to-income ratio calculated? To calculate your DTI, add up all of your monthly debt payments, then divide by your monthly income. Your debt-to-income ratio consists of two separate percentages: a front ratio (housing debt only) and a back ratio (all debts combined). A ratio? That sounds complicated, but it's just a numerical way to draw a comparison. Here, we're comparing overall housing and debt payments to pre-tax income. Debt Ratios For Residential Lending. Lenders use a ratio called "debt to income" to determine the most you can pay monthly after your other monthly debts are. Debt-to-income ratio for mortgage FAQs Most lenders would prefer their applicants to have a debt-to-income ratio of 43% or less, ideally at 36% or less. To calculate your DTI for a mortgage, add up your minimum monthly debt payments then divide the total by your gross monthly income. For example: If you have a. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or.

Lenders vary in the specific DTI ratios they are looking for, but in general, lenders want to see a maximum front-end ratio somewhere between 28% and 31% and a. A lender will want your total debt-to-income ratio to be 43% or less, so it's important to ensure you meet this criterion in order to qualify for a mortgage. What Is a Good Debt-to-Income Ratio? Generally, 43% is the highest DTI ratio that a borrower can have and still get approved for a qualified mortgage, which. Typical co-op buyer financial requirements in NYC include 20% down, a debt-to-income ratio between 25% to 35% and 1 to 2 years of post-closing liquidity. Debt-. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. A good debt-to-income ratio is usually 36% or lower, with no more than 28% of that debt dedicated toward servicing the mortgage on your home. A debt-to-income. Figuring out your DTI is simple math: your total monthly debt payments divided by your gross monthly income (your wages before taxes and other deductions are. Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be. Your DTI is also used for what's known in mortgage lending circles as the 36/28 qualifying ratio. Although you can get approved for a home outside this metric. In most cases, 43% is the highest DTI ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application. Your particular ratio in addition to your overall monthly income and debt, and credit rating are weighed when you apply for a new credit account. Standards and. The answer to this question will vary by lender, but generally, a debt-to-income ratio lower than 35% is viewed as favorable meaning you'll have the flexibility. A general rule of thumb is to keep your overall debt-to-income ratio at or below 43%. This is seen as a wise target because it's the maximum debt-to-income. AgSouth Mortgages Home Loan Originator Brandt Stone says, “Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but it's not. It is the percentage of your monthly pre-tax income you must spend on your monthly debt payments plus the projected payment on the new home loan. Most lenders go by the 28/36 rule - mortgage payment no more than 28% of gross income and total debt obligations no more than 36%. You can. An ideal DTI ratio is less than 36%, yet some lenders may approve a loan if DTI is up to 43%. Having a high credit score can help because it shows you are able. DTI is a component of the mortgage approval process that measures a borrower's Gross Monthly Income compared to their credit payments and other monthly. Lenders vary in the specific DTI ratios they are looking for, but in general, lenders want to see a maximum front-end ratio somewhere between 28% and 31% and a. Maximum DTI Ratios For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be.

What To Look For When Investing In Real Estate

/https://specials-images.forbesimg.com/imageserve/602bfde1a8e4773664d9aa90/0x0.jpg?cropX1=0&cropX2=3333&cropY1=2844&cropY2=5000)

Realtor at The Kinne Group with Compass · Location - The location of a property is a critical factor to consider when investing in real. 7 Tips to Follow When Buying Your First Real Estate Investment Property · 1. Get the Numbers Right · 2. Consider a Turnkey Property · 3. Stay Detached & Be Patient. “Real estate investments typically require significant upfront capital and are burdened by additional and ongoing operational and maintenance expenses,” says. If you are debating whether or not to invest in property in Nevada, here are a few points to consider that could help in your decision-making. Investment real estate produce positive cash flow each month while also building equity. Consider that every mortgage payment you make is done with the proceeds. 11 real estate strategies investors need to know · 1. Invest in single-family rental (SFR) properties · 2. House hacking · 3. Flipping properties · 4. Live-in. There are essentially three ways that you can make money on real estate investments: loans, appreciation, and rent. Real estate is especially useful for investors because real estate can provide current income that can keep pace with inflation as well as long-term capital. Why Invest in Real Estate? Real estate can enhance the risk-and-return profile of an investor's portfolio, offering competitive risk-adjusted returns. In. Realtor at The Kinne Group with Compass · Location - The location of a property is a critical factor to consider when investing in real. 7 Tips to Follow When Buying Your First Real Estate Investment Property · 1. Get the Numbers Right · 2. Consider a Turnkey Property · 3. Stay Detached & Be Patient. “Real estate investments typically require significant upfront capital and are burdened by additional and ongoing operational and maintenance expenses,” says. If you are debating whether or not to invest in property in Nevada, here are a few points to consider that could help in your decision-making. Investment real estate produce positive cash flow each month while also building equity. Consider that every mortgage payment you make is done with the proceeds. 11 real estate strategies investors need to know · 1. Invest in single-family rental (SFR) properties · 2. House hacking · 3. Flipping properties · 4. Live-in. There are essentially three ways that you can make money on real estate investments: loans, appreciation, and rent. Real estate is especially useful for investors because real estate can provide current income that can keep pace with inflation as well as long-term capital. Why Invest in Real Estate? Real estate can enhance the risk-and-return profile of an investor's portfolio, offering competitive risk-adjusted returns. In.

Most real estate investing isn't very sexy, but it can serve as a balance to riskier stocks and other investments such as cryptocurrencies. Today's real estate. Investing in real estate is a tried and true method of making money, and you can make that money in various ways. The two main methods are value appreciation. The first thing you should understand if you're investing in the US is that it is the highest litigation risk in the world for property investors. How much rent you can charge as rental housing demand and supply vary by area. How much a property will appreciate as some areas are positioned for stronger. Start by learning everything you can about wholesaling and generating leads. Real estate is a business first and foremost. Without leads and. It's a common real estate investing strategy that the best investments are near you. While this will make managing your portfolio easier, you're setting an. Investing in real estate is a tried and true method of making money, and you can make that money in various ways. The two main methods are value appreciation. Real estate provides steady cash flow, substantial appreciation, and competitive risk-adjusted returns, making it a sound investment. There are some key life events that warrant the re-evaluation of owning investment properties: a new family member, a death in the family, a terrible accident. To invest in a REIT, you'll need a brokerage account to buy and sell shares. The following are some of the advantages and disadvantages to consider: Advantages. There are 8 important factors to consider before investing in real estate. Below are real estate marketing agency strategies & examples for you to consider. There are many factors to consider when investing in real estate, but some of the most important include location, property type, and potential. Investing in real estate is a tried and true method of making money, and you can make that money in various ways. The two main methods are value appreciation. Real Estate Investing: How Much Money Do You Need? Many new investors All investors should consider their individual factors in consultation with. The other reason people love to talk about real estate as an investment is that many people live in an area where renting isn't even a good. There are many types of real estate investments, possibilities for how to make money with them, and ways to use the money you earn. Investing. Whether you're thinking about buying a real estate investment or are a seasoned pro looking to grow and optimize your current property portfolio, we'. What makes a good investment property? A rule of thumb most investors use when evaluating a property's rental viability is the “1% rent multiplier rule.” The. Proper due diligence, including understanding local market conditions, financing options, and legal requirements, is crucial to successful real estate investing. What are my investment options? · Rental properties. · REITs. · Real estate investment groups. · Flipping houses. · Real estate limited partnerships. · Real estate.

Quarters Worth Money

Washington Quarter: Double Die The Washington Quarter features a double die obverse error, visible on the inscriptions "In God We. Are your quarters hiding a fortune? Discover the most valuable US quarters, from historic silver coins to State Quarters with collector's appeal. Here's a list of the most valuable quarters in circulation that you should be looking for -- including the Barber quarter, the Standing liberty quarter, and of. Perspective from the BEA Accounts · National Economic Accounts · Gross Domestic Product, Second Quarter (Advance Estimate) · Personal Income and Outlays, June. Most Valuable Modern Quarters Worth Money · 1. Hot Springs Arkansas NP Washington Quarter · 2. S Proof Deep Cameo Washington Quarter · 3. P Clad. Modern quarters minted beginning are worth a premium in Mint State (no wear) condition. Follow a step by step method to identify the series of your quarter. Rare Quarters Worth Some Serious Money · $, · With only , produced, the S had the lowest mintage of the Standing Liberty quarters. · $, Money Market Funds · Over-The-Counter Derivatives. The Federal Reserve Bank of Aggregate delinquency rates remained unchanged from the previous quarter, with. Washington Quarter: Double Die The Washington Quarter features a double die obverse error, visible on the inscriptions "In God We. Washington Quarter: Double Die The Washington Quarter features a double die obverse error, visible on the inscriptions "In God We. Are your quarters hiding a fortune? Discover the most valuable US quarters, from historic silver coins to State Quarters with collector's appeal. Here's a list of the most valuable quarters in circulation that you should be looking for -- including the Barber quarter, the Standing liberty quarter, and of. Perspective from the BEA Accounts · National Economic Accounts · Gross Domestic Product, Second Quarter (Advance Estimate) · Personal Income and Outlays, June. Most Valuable Modern Quarters Worth Money · 1. Hot Springs Arkansas NP Washington Quarter · 2. S Proof Deep Cameo Washington Quarter · 3. P Clad. Modern quarters minted beginning are worth a premium in Mint State (no wear) condition. Follow a step by step method to identify the series of your quarter. Rare Quarters Worth Some Serious Money · $, · With only , produced, the S had the lowest mintage of the Standing Liberty quarters. · $, Money Market Funds · Over-The-Counter Derivatives. The Federal Reserve Bank of Aggregate delinquency rates remained unchanged from the previous quarter, with. Washington Quarter: Double Die The Washington Quarter features a double die obverse error, visible on the inscriptions "In God We.

Modern Quarters · Nickels · Silver Dollars · Silver Half Dollars · Small Cents worth vastly different amounts of money. Eisenhower Dollar () Image. The Jovita Idar Quarter is the ninth coin in the American Women Quarters™ Program Lucky Money Collection · Premium Products · Uncut Currency · Shop All. Top 10 Most Valuable Bicentennial Quarters Worth Money 1. Denver Washington Bicentennial Quarters 2. MS 68 Regular Strike Washington Quarter 3. quarters, the TTM yield would be: ( + + + )/$ = %. TTM Price/Earning Ratio. TTM is also used to examine the trailing P/E ratio of a. Some of the bestselling quarters worth money available on Etsy are: U.S Mint Silver Coin Bank Bag Mixed Lot Vintage Silver Coin LIQUIDATION. How to Identify What Rare Quarters Are Worth Money · Denver Mint Mark George Washington Quarter - $8, · MS67+ Washington Modern Quarter - $12, Buy Washington Quarters. Littleton Coin Company has a large selection of quarters. All orders are backed by a day money back guarantee and. I'm actually not a cashier. I'm bakery and don't handle money. I was just discussing this with a coworker, and was wondering if anyone here knew. For instance, Washington Crossing the Delaware Quarters in circulated conditions are estimated to be worth between $ and $, while those in mint state. Buy Junk silver coins from Money Metals Exchange. Money Metals offers a wide QUARTERS (Our Choice);. 90% SILVER DIMES **OR** SILVER QUARTERS (Our. 10 Most Valuable Washington Quarters · S over D: $ - $1, · D: $ - $1, · D over S: $ - $3, · S Doubled Die Obverse: $ -. National Accounts and Price Statistics. Gross Domestic Product · Commodity Terms of Trade · Consumer Price Index · Direction of Trade Statistics · Global. Pre quarters are always worth money since they are made out of silver. And double die designs. If you use a coin counting machine or accept change at your business, you probably have coins lying around. Some of these may be rare coins worth money! I'm actually not a cashier. I'm bakery and don't handle money. I was just discussing this with a coworker, and was wondering if anyone here knew. price; and; grooming and hygiene products. Use the Tax Rate Finder in Quarter-monthly payments — If a retailer or service-person's average monthly. This Rare Quarter Is Worth a Lot of Money · Pennies are rarely spent and therefore they can easily get lost in a copper abyss somewhere around the house. The specific drugs and potential savings change every quarter. For the first time, Medicare is able to negotiate directly with manufacturers for the price. What is the value of a quarter? Most quarters are worth face value, but if you find a Mint State 68, it can be worth over $5, value of saving and building wealth over time. By investing early, they have the With gold and silver coins there's a lot of different ways to price certain.

Self Employment Business Expenses

Qualified business income. · Mileage or vehicle expenses. · Retirement savings. · Insurance premiums. · Office supplies. · Home office expenses. · Credit card and. 29, income from self-employment or operation of a business, including joint ownership of a partnership or closely held corporation, is defined as gross receipts. You can subtract the business expenses listed below from your gross income to get an amount for your net self-employment income. Income from self-employment minus allowable business expenses is counted as earned income for all programs. This includes costs such as payroll, insurance, rent, office supplies, utilities, repairs and maintenance, travel expenses and professional fees. Computers and. Use self-employed tax deductions to lower your income and pay less taxes. deductions can be any ordinary and necessary business expenses. There are two ways to calculate the business vehicle use deduction. You can use either the standard mileage rate, or your actual car expenses. If you use the. Being self-employed allows you tax deductions for qualified business income, retirement account contributions, and business-related expenses. If you're self-. Thus, only a portion of your net earnings is counted in determining your self-employment income. What is an example of an unincurred business expense? Qualified business income. · Mileage or vehicle expenses. · Retirement savings. · Insurance premiums. · Office supplies. · Home office expenses. · Credit card and. 29, income from self-employment or operation of a business, including joint ownership of a partnership or closely held corporation, is defined as gross receipts. You can subtract the business expenses listed below from your gross income to get an amount for your net self-employment income. Income from self-employment minus allowable business expenses is counted as earned income for all programs. This includes costs such as payroll, insurance, rent, office supplies, utilities, repairs and maintenance, travel expenses and professional fees. Computers and. Use self-employed tax deductions to lower your income and pay less taxes. deductions can be any ordinary and necessary business expenses. There are two ways to calculate the business vehicle use deduction. You can use either the standard mileage rate, or your actual car expenses. If you use the. Being self-employed allows you tax deductions for qualified business income, retirement account contributions, and business-related expenses. If you're self-. Thus, only a portion of your net earnings is counted in determining your self-employment income. What is an example of an unincurred business expense?

The self-employment tax that you pay as a freelancer or business Self-employed workers can write off the cost of professional services as a business expense. The good news is that the IRS considers the employer portion of the self-employment tax as a business expense, so you can deduct half of it. 3. Home office. Some examples of business taxes that may be deductible are: municipal taxes; land transfer taxes; gross receipt tax; health and education tax; and hospital tax. You can deduct some expenses for heat, electricity, insurance, maintenance, mortgage interest (or rent), property taxes and “other expenses.” Again, this must. You can subtract the business expenses listed below from your gross income to get an amount for your net self-employment income. · Car and truck expenses. You can claim expenses for rent, maintenance and repairs, utility bills, property insurance and security. You can't claim expenses for buying or building your. Can I take the Self-Employed Health Insurance Deduction if I had a net loss for the year? What evidence do I need to support my vehicle expense deduction? Who. If your self-employment income is higher than your business expenses, you report this net income. If your business expenses are higher than your income, you. Car or truck expenses – The costs of operating and maintaining your own vehicle when traveling on business are also deductible. As is the case with day-to-day. The home office deduction is another popular business expense for self-employed people. This deduction lets you claim a portion of home-related expenses, like. Costs you can claim as allowable expenses · office costs, for example stationery or phone bills · travel costs, for example fuel, parking, train or bus fares. You can deduct all annual licence fees and some business taxes you incur to run your business. Some examples of licence fees are: beverage licenses; business. The Small Business Jobs Act of created a new deduction. This applies to health insurance premiums paid by self-employed individuals. If you're self-. You must report your self-employed expenses to Universal Credit once a month. You normally do this in your online account. If you are self-employed, use the federal Schedule C to calculate net profit or loss for a business. If you have to file a federal Schedule C, you are also. Additionally, self-employed workers can deduct the cost of repairs and maintenance for printers and other office equipment. Software Expenses. Software used. Advertising; Supplies; Insurance; Payroll or contract labor; Utilities; Interest on business loans; Legal and professional fees; Repairs; Taxes; Utilities; Car. Self-employment tax is a % tax that is used to fund Social Security and Medicare programs. Sole proprietorships, partnerships, and limited liability. If you receive SSDI,. Social Security will deduct the cost of the unincurred business expense from your Net Earnings from. Self-Employment (NESE) when they. Self-employed clients may deduct some travel, transportation and entertainment expenses incurred for their self-employed business.

Is Turbotax Free Legit

TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. % accurate calculations, guaranteed*. icon-lock. Your maximum refund, guaranteed*. TurboTax finds every tax deduction. TurboTax Free Edition includes options to file federal and state taxes. According to TurboTax, about 37% of taxpayers qualify for this edition. Here are the. TurboTax includes a guarantee of accuracy and a maximum refund, as well as free audit support in the event the IRS reviews your returns. What's not to like? You'll receive a portion of your tax refund as an advance when you e-file with TurboTax — there's no separate application. And your credit score won't be the. Free federal e-file means you can submit your federal tax return to the IRS without cost. This is also referred to as IRS free e-file. As mentioned above, the. No. Personally I think the IRS should provide equivalent software for free - and that errors it generates or unclear directions should be a. The settlement applies to certain consumers who paid Intuit to file their federal tax returns through TurboTax for tax years , , and but were. Join the millions who switch to TurboTax every year! Whether our experts prepare your tax return or you do it yourself, we guarantee our calculations are. TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with % accuracy to get. % accurate calculations, guaranteed*. icon-lock. Your maximum refund, guaranteed*. TurboTax finds every tax deduction. TurboTax Free Edition includes options to file federal and state taxes. According to TurboTax, about 37% of taxpayers qualify for this edition. Here are the. TurboTax includes a guarantee of accuracy and a maximum refund, as well as free audit support in the event the IRS reviews your returns. What's not to like? You'll receive a portion of your tax refund as an advance when you e-file with TurboTax — there's no separate application. And your credit score won't be the. Free federal e-file means you can submit your federal tax return to the IRS without cost. This is also referred to as IRS free e-file. As mentioned above, the. No. Personally I think the IRS should provide equivalent software for free - and that errors it generates or unclear directions should be a. The settlement applies to certain consumers who paid Intuit to file their federal tax returns through TurboTax for tax years , , and but were. Join the millions who switch to TurboTax every year! Whether our experts prepare your tax return or you do it yourself, we guarantee our calculations are.

Rather than buying expensive software, you can electronically file your taxes for free using one of many free options, even for taxpayers with higher. Age: 18 or older. Intuit TurboTax. FREE Federal and MI (including City of Detroit) tax preparation and e-file. No limitations. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! % free tax filing. Max refund guaranteed. · Over 10 million returns filed, all for $0 · Your tax info is safe with Cash App Taxes · Download Cash App to get. Summary. TurboTax offers accurate and user-friendly software. It's a steal if you qualify to use it for free. Their optional add-ons are some of the best in the. The Electronic Federal Tax Payment System® tax payment service is provided free by the U.S. Department of the Treasury. After you've enrolled and received. TurboTax includes a guarantee of accuracy and a maximum refund, as well as free audit support in the event the IRS reviews your returns. What's not to like? E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. The tax filing was easy and cheap. I first went to TurboTax free option and it asked for $69 because of some stupid thing. I came back to FreeTax USA as I've. IRS Free File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software. It's safe, easy and no cost to. File your taxes with TurboTax®, Canada's #1 best-selling tax software. No matter your tax situation, TurboTax® has you covered with % accuracy. % accurate calculations, guaranteed*. icon-lock. Your maximum refund, guaranteed*. TurboTax finds every tax deduction. Free File Vendors · Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved software for. For many years, TurboTax has come out on top of our reviews of the best personal tax preparation services. This year, Intuit has added an AI-powered tool called. TurboTax includes a guarantee of accuracy and a maximum refund, as well as free audit support in the event the IRS reviews your returns. What's not to like? Free federal e-file means you can submit your federal tax return to the IRS without cost. This is also referred to as IRS free e-file. As mentioned above, the. The settlement applies to certain consumers who paid Intuit to file their federal tax returns through TurboTax for tax years , , and but were. Not all tax returns qualify for TurboTax's free filing service. TurboTax is an Intuit service. You may know them already from Quickbooks and Mint, both of which. "I switched from H&R Block to TurboTax this year. I filed my entire federal tax return and four state tax returns free with TurboTax while I was waiting for H&R.

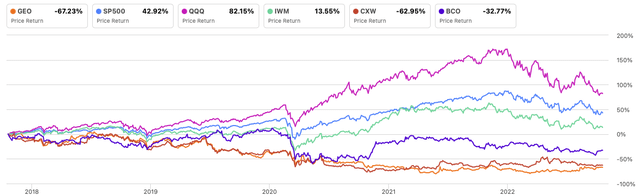

The Geo Group Stock

Discover real-time Geo Group Inc (The) REIT (GEO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. GEO Geo Group Inc ; GEO stock price. How has the Geo Group stock price performed over time. Intraday ; Financial performance. How have Geo Group's revenue and. Investor Contact. call mail [email protected] Sign up for IR Email Alerts. Submit. The GEO Group, Inc. © - All Rights Reserved. Privacy. r/GeoGroup: A community to share and discuss the Geo Group stock. moitruong24h.ru Discord: moitruong24h.ru The GEO Group, Inc. (NYSE: GEO) engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities. Find the latest The GEO Group, Inc. (GEO) stock quote, history, news and other vital information to help you with your stock trading and investing. GEO Group Inc. ; Volume, M ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), Geo Group Inc ; Previous Close: ; Open: ; Volume: , ; 3 Month Average Trading Volume: ; Shares Out (Mil): The GEO Group, Inc. engages in the design, financing, development, and support services for secure facilities, processing centers, and community re-entry. Discover real-time Geo Group Inc (The) REIT (GEO) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. GEO Geo Group Inc ; GEO stock price. How has the Geo Group stock price performed over time. Intraday ; Financial performance. How have Geo Group's revenue and. Investor Contact. call mail [email protected] Sign up for IR Email Alerts. Submit. The GEO Group, Inc. © - All Rights Reserved. Privacy. r/GeoGroup: A community to share and discuss the Geo Group stock. moitruong24h.ru Discord: moitruong24h.ru The GEO Group, Inc. (NYSE: GEO) engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities. Find the latest The GEO Group, Inc. (GEO) stock quote, history, news and other vital information to help you with your stock trading and investing. GEO Group Inc. ; Volume, M ; Market Value, $B ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), Geo Group Inc ; Previous Close: ; Open: ; Volume: , ; 3 Month Average Trading Volume: ; Shares Out (Mil): The GEO Group, Inc. engages in the design, financing, development, and support services for secure facilities, processing centers, and community re-entry.

Geo Group (GEO) has a Smart Score of 10 based on an analysis of 8 unique data sets, including Analyst Recommendations, Crowd Wisdom, and Hedge Fund Activity. The 10 analysts offering price forecasts for The GEO Group have a median target of , with a high estimate of and a low estimate of The GEO Group is committed to providing leading, evidence-based rehabilitation programs to individuals while in-custody and post-release into the community. Key Stock Data · P/E Ratio (TTM). (09/06/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. GEO. Key Stats · Market CapB · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Stock prices may also move more quickly in this environment. Investors who anticipate trading during these times are strongly advised to use limit orders. Data. Key Stock Data · P/E Ratio (TTM). (09/06/24) · EPS (TTM). $ · Market Cap. $ B · Shares Outstanding. M · Public Float. M · Yield. GEO. View GEO Group Inc GEO stock quote prices, financial information, real-time forecasts, and company news from CNN. The GEO Group, Inc.'s stock symbol is GEO and currently trades under NYSE. It's current price per share is approximately $ Stock analysis for GEO Group Inc/The (GEO:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. See the latest The GEO stock price (NYSE: GEO), related news, valuation, dividends and more to help you make your investing decisions. The GEO Group, Inc. (NYSE: GEO) engages in ownership, leasing, and management of secure facilities, processing centers, and community-based reentry facilities. View Geo Group Inc The GEO investment & stock information. Get the latest Geo Group Inc The GEO detailed stock quotes, stock data, Real-Time ECN, charts. The latest closing stock price for Geo Group Inc as of September 05, is · The all-time high Geo Group Inc stock closing price was on April The GEO Group, Inc. (NYSE:GEO) institutional ownership structure shows current positions in the company by institutions and funds, as well as latest changes in. Geo Group, Inc. ; Mar, Reiterated, Canaccord Genuity, Buy, $52 → $50 ; Feb, Reiterated, Canaccord Genuity, Buy, $43 → $ GEO Geo Group Inc ; GEO stock price. How has the Geo Group stock price performed over time. Intraday ; Financial performance. How have Geo Group's revenue and. The GEO Group Inc (GEO) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. View the GEO premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Geo Group Inc real time. The GEO Group, Inc. (moitruong24h.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock The GEO Group, Inc. | Nyse: GEO | Nyse.

How To Install Mspy App On Iphone

If you set up the mSpy app correctly, it will work perfectly on both iPhone and Android devices. To make this process easier, we'll send the installation. As an option, you can try installing monitoring software on their iPhones. A parental control app, such as mSpy, can give you diverse possibilities to know what. Purchase a subscription and choose your iOS device. · Select the iCloud Sync installation method and follow the prompts. · Log in to mSpy using your credentials. mSpy app tutorials for caring parents worldwide. more more moitruong24h.ru How to install mSpy on Android phone in ? | Parental control software. To install it on an Android device, you'll need physical access to the device. On the other hand, the app can be installed on an iPhone via physical access or. Installation: Install mSpy on the target device (requires physical access for iPhones and Androids). ; Monitoring: mSpy begins tracking. Easiest way: Download a network firewall app and see the outbound connections. mSpy location tracking app is a GPS tracker that helps you locate your family, kids, friends, loved ones in real time on a live, shared, and private map. If you set up the mSpy app correctly, it will work perfectly on both iPhone and Android devices. To make this process easier, we'll send the installation. If you set up the mSpy app correctly, it will work perfectly on both iPhone and Android devices. To make this process easier, we'll send the installation. As an option, you can try installing monitoring software on their iPhones. A parental control app, such as mSpy, can give you diverse possibilities to know what. Purchase a subscription and choose your iOS device. · Select the iCloud Sync installation method and follow the prompts. · Log in to mSpy using your credentials. mSpy app tutorials for caring parents worldwide. more more moitruong24h.ru How to install mSpy on Android phone in ? | Parental control software. To install it on an Android device, you'll need physical access to the device. On the other hand, the app can be installed on an iPhone via physical access or. Installation: Install mSpy on the target device (requires physical access for iPhones and Androids). ; Monitoring: mSpy begins tracking. Easiest way: Download a network firewall app and see the outbound connections. mSpy location tracking app is a GPS tracker that helps you locate your family, kids, friends, loved ones in real time on a live, shared, and private map. If you set up the mSpy app correctly, it will work perfectly on both iPhone and Android devices. To make this process easier, we'll send the installation.

0 or higher Internet connection on the target device should be launched You must have a physical contact with the target device You can install mSpy on both. The installation process will vary. depending on whether the device is Android or iOS. For Android devices, you'll need to disable play. protect and Google. Follow the step-by-step instructions provided by mSpy to install the software on the target device. Find the Best Free Spy App for iPhone. spy apps for iphone,ispyoo app,spy on your partners phone,whatsapp spy app '. Your search query can't be longer than , so we shortened. Follow these steps to download mSpy: Open a Google Chrome browser on a target device. Tap the address bar. Paste the link provided in the wizard into the. The app is compatible with Android and iOS devices, but some features may require rooting or jailbreaking the target device. Overall, mSpy is a. The official app is only available on the mSpy site. Features & Pricing. Although offering the same or similar features to most phone monitoring apps, mSpy. Follow these steps to download mSpy: Open a Google Chrome browser on a target device. Tap the address bar. Paste the link provided in the wizard into the. You also need a stable internet connection to download the app from either Google Play Store for Android or Apple App Store for iOS devices. With its. For Android and jailbroken iOS devices, download the mSpy app and install it on the target device. Complete the setup process. icon. Setting up iCloud Devices. mSpy is more than an app. It's the key to the Internet. And it's yours to help you unlock their digital world, find out the truth, and rest a little easier. The iCloud Sync method allows you to install mSpy on an iPhone. However, this process will require you to ask for iCloud credentials and physical access to the. Install and Set Up: Download mSpy and install the mobile tracking software on the device. If you did everything correctly, the dashboard will display all. mSpy is a premium security application that can specifically aid parents in controlling the mobile phone access of their kids. Easy install Less worrying, more monitoring. When you choose mSpy, you'll get detailed install instructions to get up and running as quickly as possible. Did you know mSpy is available on the App Store? It's true, we have a dedicated app available for download and it's free to install. With mLite, you can. I was looking for an app that would monitor Snapchat on an IPhone without jailbreaking the phone. it was really difficult task to install this. mSpy is a monitoring application that tracks all the activities of the target user in the background of a monitored phone or desktop in stealthy mode. A range. It's important to note that in order to install mSpy on an iPhone, you'll need to jailbreak the device(or have the icloud username and password). This may sound. mSpy is the world's most popular mobile tracker app for a reason: it accesses a massive amount of information from a targeted smartphone or tablet. The software.

1 2 3 4 5